News

How Will Gambling Affiliates be Affected by Rule Changes in the UK?

As the iGaming market in the UK has grown exponentially since 2010, we’ve also seen associated money-making opportunities emerge in the sector.

For example, the most successful gambling affiliates can earn in excess of £20,000 per month when ranking well for competitive search volume keywords, simply by promoting a particular casino brand through their site.

However, given the recent proposals aimed at safeguarding players in the iGaming market and the wider impact of Brexit on the European gambling industry in the UK, the future for affiliates has become uncertain. But how will they be affected by any rule changes?

Exploring Current Affiliate Restrictions

During the House of Lords Select Committee meeting on the Social and Economic Impact of the Gambling Industry in February, delegates discussed a wide range of measures to help protect vulnerable and underage gamblers.

They also entertained the ambitious proposals by the All-Party Parliamentary Group (APPG) for Gambling Related Harm, which included measures such as a £2 online slots betting cap and a comprehensive review of the licensing criteria imposed on operators.

Another key topic for discussion was the role of affiliates, and more specifically how operators feel about regulating these entities and the way in which they advertise to their customers.

Currently, there is a clear rule which makes operators liable for the actions of their affiliate partners, with this having been in place since the last review of the market in 2018.

This rule created a sense of accountability amongst operators and made them directly responsible for the marketing activity (and breaches) of their affiliates, resulting in a slew of financial sanctions for brands across the board.

This was also part of a wider drive to curb the publication of misleading information on affiliate sites, which could occasionally be utilized to target vulnerable or underage players.

Aside from misleading advertising, this body of rules and wider regulatory framework also covers specific database practice requirements, including the requirement to demonstrate explicit consent for any person who happens to be on an affiliate’s email marketing list.

By attempting to control sponsored iGaming messaging in this way, both the UK regulator and the government caused a considerable splash in the affiliate market.

For example, Sky Bet closed their affiliate program completely after the new rules were imposed, while a host of other market-leading operators listed on mybettingsite.uk ceased to partner with their most inefficient and untrustworthy affiliates.

This also contributed to the significant spike in mergers and acquisitions in the iGaming market during 2018/19, so it should come as no surprise that stakeholders are watchful in the event that new affiliate laws are passed.

So, What Does the Future Hold for iGaming Affiliates?

The main worry here is that the previous measures clearly have not resulted in the level of control and conformity that regulators would like, which is why alternative (and potentially stricter) measures may be under consideration.

In fact, the most logical and likely move would be to see the government (in conjunction with the UK Gambling Commission) attempt to regulate affiliates and their activity directly.

In theory, this could broadly follow the US model, where sports betting affiliates are required to register or license their operations in full before deals can be struck to promote online sportsbooks and iGaming brands.

This would not only potentially result in the formation of a new and standalone regulatory body, but costs may also be introduced to create a barrier to entry for new affiliates and make the practice less profitable for rogue operators.

Just as in 2018/19, any new rule changes could also trigger another wave of mergers and acquisitions.

In this instance, such strategic moves could well help smaller operators to absorb increased operational costs, while enabling larger corporations to strengthen their market share.

On a fundamental level, however, any new rule changes would require operators (and, to a lesser extent, affiliates) to boost their legal representation, in order to help minimize regulatory costs and pay for any external legal support that may be required.

These challenges will be compounded by Brexit, particularly for UK operators who may also be struggling with the increased RGD levy and other regulatory restrictions.

So, all stakeholders will be waiting with bated breath in the coming months, to see which of the new iGaming rules and regulations are likely to impact on the lucrative practice of affiliate marketing.

Affiliate Announcements

Discover Affigates: BetConstruct’s Innovative Affiliate Network for the iGaming Sector

Industry powerhouse BetConstruct is announcing the official launch of Affigates, a full-scale affiliate ecosystem that is set to redefine how operators and partners connect in iGaming.

What Sets It Apart?

Affigates brings affiliate software, affiliate program management, and a performance-tested network under one roof, designed from the ground up for scale, speed, and smarter growth.

From AI-aided management to a proprietary scoring system that filters the noise and finds real partners, Affigates removes the friction and delivers results that actually move the needle. With over 4500+ affiliates, 630+ active partner operators, and access to more than 30 million players, the ecosystem is already making a significant impact.

See It First at iGB L!VE

Affigates is making its global debut at iGB L!VE in London, where the sharpest minds in iGaming converge. You will find the ecosystem in action at its own stand, C40, as well as the dedicated team behind it.

Catering to both ready-to-scale operators and affiliates aiming higher, Affigates is here to deliver the affiliate solution the industry has been waiting for.

Affiliate Announcements

Affilka by SOFTSWISS Unveils Updates for Affiliates

Affilka by SOFTSWISS, an award-winning affiliate management software platform, has announced a suite of new product updates for the affiliates. The latest release introduces a Traffic Report with advanced clicks analytics, an API for extracting campaigns and tracking links, and a sub-affiliate NGR-based revenue share model.

Traffic Report: In-depth Click Analysis

This new Traffic Report focuses on detailed click-level analytics, offering in-depth insights into clicks, registrations, deposits, and conversion rates such as click-to-reg and click-to-FTD – all in one place. It includes several key features for flexible data analysis:

- Multi-dimensional filtering and data grouping: The report enables users to filter and break down the data into granular views across multiple dimensions, offering detailed insights by traffic source, campaign, country, device type, IP address, and more. Notably, click data is transferred to the report in real time, providing instant visibility into user activity.

- CSV data export: The report supports one-click CSV export, allowing affiliates to easily download raw data for offline analysis or sharing.

- Historical data access: Affiliates can review traffic statistics from 1 January 2023, enabling year-on-year comparisons and long-term trend evaluation.

Gleb Bichan, Product Lead at Affilka by SOFTSWISS, comments: “At Affilka, we know how crucial it is for operators and affiliates alike to make data-driven decisions. That’s why we’re introducing tools like the Traffic Report to help partners become more productive and uncover new insights faster.”

API for Marketing Campaigns and Tracking Links

In addition to the existing Reports API, affiliates can now access data on their marketing campaigns and tracking links directly via API, allowing for automated data extraction and custom integrations. With this API access, users can retrieve up-to-date lists of marketing campaigns, promo codes, and related performance metrics directly via API calls. This improvement helps Affilka clients automate their reporting workflows and integrate affiliate data with external BI tools, reducing manual effort and ensuring timely access to key information.

New Sub-affiliate Revenue Share Model

Responding to client feedback, Affilka’s team also features a new sub-affiliate reward type. This allows affiliates to earn a commission based on the Net Gaming Revenue (NGR) generated by players referred by their sub-affiliates, offering a more direct revenue-sharing approach. By aligning earnings with the actual revenue brought in by sub-affiliates, the update incentivises collaboration and gives experienced affiliates a stronger stake in mentoring their referred partners.

Gleb Bichan adds: “For us, it’s important that affiliates not only use the product but also feel it’s built with their real needs in mind. We regularly gather feedback and implement improvements that make daily workflows more transparent and efficient. Features like the Traffic Report, API access, and new reward types are direct responses to partner requests – and we’re not stopping there. We plan to introduce even more tools designed to simplify affiliate operations, so stay tuned for upcoming updates.”

Affilka by SOFTSWISS will be presented at iGB in London from 3 to 4 July 2025. Attendees of the event can learn more about new features directly from the Affilka team and see how these innovations support better affiliate programme management.

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience developing innovative solutions for the iGaming industry. SOFTSWISS holds a number of gaming licences and provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Online Casino Platform, the Game Aggregator with over 30,000 casino games, the Affilka Affiliate Platform, the Sportsbook Software and the Jackpot Aggregator. In 2013, SOFTSWISS revolutionised the industry by introducing the world’s first Bitcoin-optimised online casino solution. The expert team counts over 2,000 employees.

News

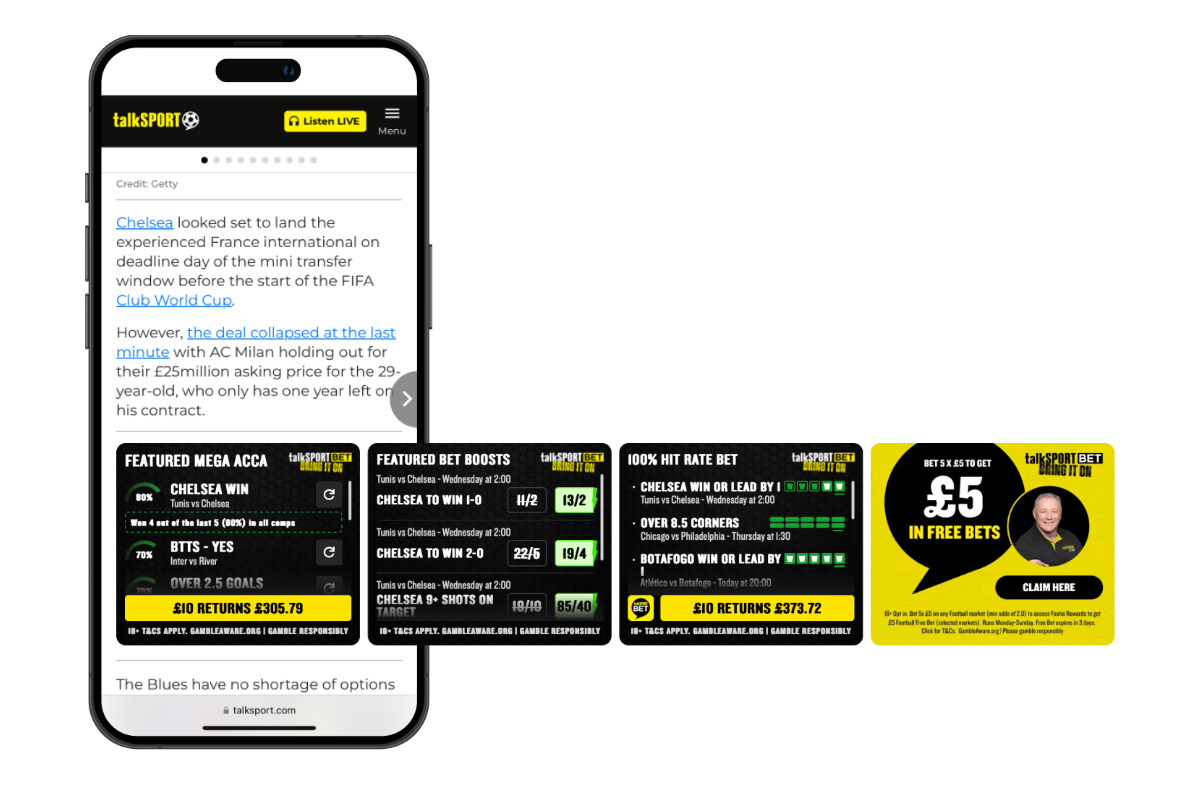

Checkd Dev Launches New Affiliate-Focused AdTech Product Powered by BRUNO Platform

-

Seamless integration of sign-up offers, bonuses, promotions, and ambassador-led bets

-

A streamlined back end powered by Checkd’s Automated Betting Solution CMS, enabling affiliates to easily configure and control the full content proposition

-

A tailored, user-centric experience that boosts engagement and monetisation potential which is based on many years of Checkd’s learnings within the ultra-competitive UK affiliate landscape

-

iGB7 days ago

iGB7 days agoRoyal Partners is touching down in London for this year’s most anticipated conference!

-

News6 days ago

News6 days agoNorth Star Network acquires BasketUSA.com and BasketEurope.com

-

News6 days ago

News6 days agoCheckd Dev Launches New Affiliate-Focused AdTech Product Powered by BRUNO Platform

-

Affiliate Announcements5 days ago

Affiliate Announcements5 days agoAffilka by SOFTSWISS Unveils Updates for Affiliates

-

Affiliate Announcements5 days ago

Affiliate Announcements5 days agoDiscover Affigates: BetConstruct’s Innovative Affiliate Network for the iGaming Sector